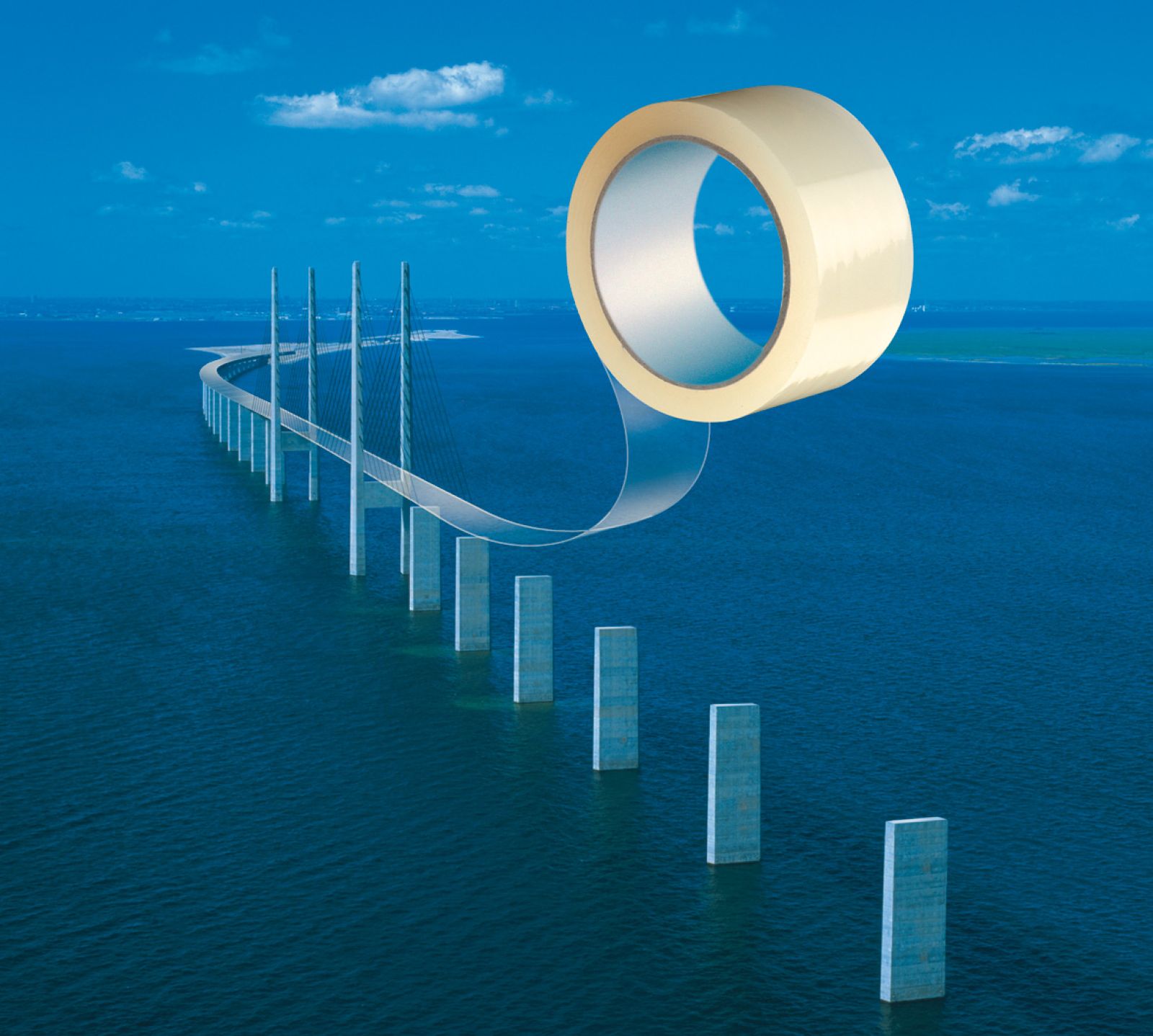

Global, European specialty tape markets in 2016

Overview:

- At the end of 2015, the worldwide tape market represented 41.1 billion square metres (bsm) of tape materials produced annually, 14% or 5.7 bsm of which are specialty tapes

- The global specialty tape market is expected to have a CAGR of 5% between 2011 and 2019, with Asia leading at 7-8%; the European specialty tape market will see a CAGR of 2%

- In both world and European markets, medical, hygiene, electrical, electronic and automotive tapes make up the largest application segments

- The real driver for growth is the economic situation in a region, including social as well as financial economic metrics

- In terms of specialty tapes, Germany represents 30% of the total market within Europe and the largest geographical market

- The largest material category of European specialty tape produced is woven/non-woven

- One of the material segments which has seen growth is acrylic foam tapes.

- Solvent-based and hot melt make up 85% of the adhesives used in specialty tape production

- Silicone-based adhesives represent a small share of the total market but are the fastest-growing technology at 6-8% per annum

- Film-based liners make up 21% of the release liner market for specialty tapes and as a substrate are growing at twice the rate of papers.

View the complete slide presentation (members only)

Afera's Hamburg conference presentation series

At Afera’s Annual Conference in Hamburg, Corey Reardon shared the updated results of AWA’s extensive research into the specialty tape market worldwide in 2015, as well as additional insights and answers to purchasers’ questions. President and CEO of AWA Alexander Watson Associates since acquiring the business in 1999, Mr. Reardon has 30 years of experience in the pressure sensitive and materials industry, having worked in product management, marketing and business development in companies such as Loparex and Avery Dennison.

years of experience in the pressure sensitive and materials industry, having worked in product management, marketing and business development in companies such as Loparex and Avery Dennison.

Covering the European specialty pressure sensitive tape market in more depth than the 2015 study, AWA’s Global Specialty Tape Market Overview: Growth and Opportunities was published as a special edition for Afera Members. Conference participants had the option of buying it beforehand and submitting questions to Mr. Reardon to be addressed during his Hamburg presentation, which highlighted the market characteristics and growth trends of the global and European specialty tape markets.

The bottom line: The specialty tape market is constantly evolving. The good news is that Mr. Reardon doesn’t see any disruptive technologies or radical changes currently or ahead of us. Most companies in the value chain can adapt their organisations to changes as the markets for technology and materials evolve. There are market opportunities in the development of new technologies and applications in the medical, hygiene, automotive, electric and electronics segments. Even the building and construction industry is picking up slowly in Europe, which will mean growth for tapes in those product areas. The real driver for growth is the economic situation in a region, including social as well as financial economic metrics.

Global adhesive tape market

As of 2015, the global adhesive tape market represents approximately 41.1 bsm of tapes produced. The total tape market can be split into four broad industry categories: packaging tape representing 68%, masking tapes 8%, consumer and office products tapes 10%, and specialty tapes 14% of total tapes produced on a global basis. The study highlights the specialty tape market, which makes up 14% of the total tape market worldwide or 5.7 bsm of laminated and adhesive-coated tape material.

Supply and demand in the value chain

Looking closer at the value chain (below), on the far left are raw materials suppliers, including makers of paper, film, resins, specialty synthetics, adhesives, silicones and release liners. Moving to the demand side on the right, there are the adhesive coaters which adhesive coat and laminate these materials to make various tape products or products that will become tapes as they are sold to distributors, slitters, gasket producers, etc. in the centre of the value chain. Then the tapes make their way into the various application segments and are sold to automobile producers, Airbus, etc. at the demand side of the value chain.

Breakdown by region

In 2015, the global market size for tapes was approximately 41.1 bsm. The regional shares of the market: Europe at 20%, North America 20%, Asia 51%, South America 5%, and Africa & Middle East 4%. Asia’s steady increase from about 30% to over 50% over more than a decade is a notable trend. The same year, the global market size for specialty tapes was approximately 5.7 bsm. The regional share for Asia was 44% and growing.

Global specialty tape market breakdown by application segment

Growth and opportunities can be seen from another perspective when looking at the various application segments of tapes. Mr. Reardon noted that there are many different ways to segment and sub-segment a market. In conducting their market research at AWA, they have broken down the global specialty tape market into the following main end-use applications: automotive, aerospace, white goods, electronic, electrical, paper and printing, building and construction, medical, hygiene, defence and military, retail and graphics, sports and entertainment, and miscellaneous.

applications: automotive, aerospace, white goods, electronic, electrical, paper and printing, building and construction, medical, hygiene, defence and military, retail and graphics, sports and entertainment, and miscellaneous.

The miscellaneous category is large at 1%, but specialty tapes include many unique, one-off applications that don’t fall into any other defined category.

Similar to their proportions in 2014, medical and electronics each represent 15% of the total market worldwide, automotive 14%, electrical 12%, white goods 12% and hygiene 11%. The total production of ~5.7 bsm is spread fairly evenly over the applications segments, balancing some of the growth dynamics on a regional and global basis.

Segment growth trends

Looking ahead, CAGR from 2011-2019 is expected at 5%, varying by region. Asia Pacific, which represents 41% of the market, will drive some of this growth at 7-8%. In the more mature markets of Europe and North America, the average growth rate will be lower than that of Asia.

Segment growth drivers: Economic situation in the region #1

There are many macro trends which are driving growth for tapes, such as technological changes in the automobile and electronics industries. Adhesive technology development is also leading to new applications for specialty tapes in binding and adhering, replacing functional technologies for bonding.

But in order to zero in on where the global specialty tape sector’s growth is derived from, AWA conducted approximately 80 telephone interviews on a global basis on a number of tape-industry-related topics. Two of the questions: What are the influences driving growth? And is it influencing it significantly, somewhat or not at all? The result was the creation of an organic list of growth drivers in the global specialty tape market, including, in order of significance:

- Economic situation in the region

- Production efficiency/costs

- Digitalisation/mobile societies

- Technological advancements

- Population growth

- Ageing population

- Sustainability.

Interestingly, sustainability remains a buzzword and an important topic of discussion as well as many business goals and strategies. Yet it doesn’t seem to drive growth at all. The real driver for growth is the economic situation in a region. This means more than GDP or economic growth or industrial output, says Mr. Reardon, because it also has to do with social economic metrics in addition to financial economics.

European specialty tape market breakdown by application segment

European specialty tape market breakdown by application segment

The breakdown in application segments of tapes in the European market is similar to that of the global market. For these measurements, Europe comprises the U.K., Scandinavia and the rest of mainland Europe, including Russia, Eastern Europe and Turkey.

Medical is at 18%, hygiene 14%, automotive 13% and miscellaneous 2%. These specialty specialty areas, plus electrical and electronic, tend to be more concentrated when moving away from Asia and focussing on the European and North American markets. In general, the Asia market will have higher concentration in white goods, paper and printing, and building and construction.

Segment stats

The following segments represent sizeable volumes across the European specialty tape market:

- Medical tapes make up the largest market segment at 18% or 227 million square metres (msm) of material

- Hygiene tapes make up 14% or 167 msm of material

- Automotive and electrical tapes each make up 13% or 159 msm of material

- Electronic tapes make up 9% or 114 msm of material

- Building and construction make up 6% or 71 msm of material

- Sport and entertainment make up 1% or 16 msm

- Military and defence make up 1% or 11 msm.

Country/regional stats

In terms of specialty tapes, Germany represents 30% of the total market within Europe and the largest geographical market. Although larger than Germany in total tape production including packaging, masking and consumer tapes, Italy represents just 10% of the specialty market. France represents 20%, the Benelux 17%, U.K. 13% and the rest of Europe 10%.

Materials

The materials categories of tape produced:

|

18% | |

|

17% | |

|

16% | |

|

13% | |

|

12% | |

|

11% | |

|

5% | |

|

4% | |

|

3% | |

|

1% |

Woven/non-woven and PVC tapes make up more than one-third, and the top five categories make up more than three-quarters of the market. The large volumes of materials lie in Germany. By popular request, the category woven/non-woven will be broken down in more detail in future AWA studies.

Woven/non-woven and PVC tapes make up more than one-third, and the top five categories make up more than three-quarters of the market. The large volumes of materials lie in Germany. By popular request, the category woven/non-woven will be broken down in more detail in future AWA studies.

Growth

Between 2011 and 2019, we are seeing CAGR in the range of 2%.

European specialty tape market major applications

What is included in the top four categories?

What is included in the top four categories?

Medical (18%)

- Wound care

- Surgical drapes/ostonomy stoma care

- Plasters

- Electrode mounting tapes.

Hygiene, including both infant and adult products (14%)

- Re-closure tapes

- Attachment tapes.

Automotive, including trucks and other vehicles (13%)

- Interior and exterior fastening and mounting tapes for panels, trim, carpet, lighting, etc.

- Foam tapes for anti-vibration and noise reflection

- Wire harnessing tapes

- Gasket and sealing tapes

- Brake pads

- Other components.

Electrical (13%)

- Electrical cable identification and wrapping tapes

- Electrical insulation tapes for component manufacture.

European specialty tape market key growth segments and drivers

The medical, electrical and automotive segments show the highest growth across Europe at 4% and 3%. White goods is actually declining.

Medical sees high growth, attractive technology

The highest growth segment across Europe is medical with 18% of the market. This is driven by the demands for new technologies and applications by an ageing population. Newborns and the general population increasingly require drapes, skin and wound care products too.

As new functionalities are in place, new applications within the segment appear, such as skin-friendly medical tapes, surgical tapes that are equipped with gel adhesive, or heat-activated diagnostic tapes. Nanotechnology related to microbial technologies for skin care adhesives is a huge area of R&D that is driving the development of the medical tapes segment in Europe. This same dynamic is not evident in the larger Asian market.

Automotive

Representing 13% of the European market and growing at a rate of 3%, automotive tapes are increasingly replacing traditional fastening and bonding technologies. Another significant, albeit less obvious, trend in the automotive sector is the increase of new entrants. Tesla, BMW and other manufacturers’ new electric cars are influencing a shift in technology of automotive components. R&D is focussed on lightweighting, building strength into cars, and saving time and money through adhesive technology and products that use specialty tapes.

Electrical

Modernised electricity distribution systems come with construction, which is driving growth in the electrical segment. A slow recovery in European construction is expected, but once this picks up – and there are signs that it is beginning to – we’ll see increasing demand for high-voltage cable and broadband. Manufacturing of quality products will return to Europe and the U.S. This will be a departure from the last twenty years of seeing manufacturing in building and construction materials moving to lower-cost regions of the world.

Acrylic foam tapes

One of the material segments which has seen growth is acrylic foam tapes. Because they exhibit a higher bonding strength, acrylic foam tapes are used for adhering metal-to-metal and metal-to-plastics and are replacing rivets and mechanical fastening systems in heavy applications such as automotive and construction, in which the requirements are very demanding and bonding strength is critical.

Mr. Reardon cited the example of acrylic foam in 3M’s VHB™ Tapes, which provide strength and durability in extreme applications. They resist stress, fatigue, vibration, heat, cold, temperature cycling, moisture, solvents and UV light. Although this is a market area that has been dominated by 3M, we are seeing ever more players entering the market with different levels of performance in acrylic foam tape technology.

Acrylic foam tapes have been growing 4-6% on a global basis over the last 3-5 years, including the existing market and new applications. This may be higher, in the range of 10-12% for some applications and certain technological developments in, for example, automotive and building and construction. This speed of growth will continue over the next 3-5 years.

Particularly double-coated tapes are used in automotive, electronics and building and construction applications, such as in automotive and electronics equipment assembly and structural glazing of the glass to buildings. The trend in using acrylic foam tapes, particularly as there are new entrants in the market, is growing.

Particularly double-coated tapes are used in automotive, electronics and building and construction applications, such as in automotive and electronics equipment assembly and structural glazing of the glass to buildings. The trend in using acrylic foam tapes, particularly as there are new entrants in the market, is growing.

There is a differentiation between the performance characteristics of acrylic foam tapes: Very high-performing acrylic foam tapes are used for true applications which require the highest level of performance. There are also acrylic foam tapes which perform less but meet the needs of less stringent or demanding applications.

Adhesives

The total adhesive market for specialty tapes in Europe represents 68,000 metric tons of adhesive used. The adhesive used in specialty tape production:

|

48% | |

|

37% | |

|

9% | |

|

4% | |

|

2% |

Solvent-based is the main adhesive used for European specialty adhesive tapes. It is used when high-performance adhesion is required, calling for a specialty tape. The second largest category is hot melt, which is used in low-cost applications which are subject to less stress, i.e. lower stress requirements can be met with lower adhesion requirements. Silicone-based adhesives form a niche area that is growing at a rate even faster than acrylic foam tape technologies.

Hot melt adhesives are used in tape applications in the automotive, hygiene, paper and printing, and retail and graphics segments. Less demanding requirements can be met with lower adhesion of hot melt, but hot melt (UV-curable) is used in automotive, aerospace and electronics applications which may become more demanding.

Hot melt adhesives are used in tape applications in the automotive, hygiene, paper and printing, and retail and graphics segments. Less demanding requirements can be met with lower adhesion of hot melt, but hot melt (UV-curable) is used in automotive, aerospace and electronics applications which may become more demanding.

Silicone-based adhesives represent a small share of the total market but are growing 6-8% per annum on a global basis and fairly consistently across every region. Probably the fastest-growing defined adhesive technology, silicone-based is used in aerospace, automotive, electrical and electronic applications, which are all the high-growth segments.

Release liners

Release liners are used mainly in double-coated tapes and transfer (unsupported) tapes such as splicing tapes. Substrates of release liners used in the tapes segment:

|

54% | |

|

21% | |

|

17% | |

|

8% |

Release liners used in the tapes segment make up 5% of the total European release liner market, and the tapes segment is the second fastest-growing in the release liner market across Europe.

Film-based liners represent just above 20% of the substrate category and play an increasingly important part of the liner substrates used in specialty tapes. Films continue to see growth at twice the rate of glassine/SCK paper, which represents over 50% of the total market.

Production and demand

The European production volume of adhesive tapes is 1.351 msm. European demand is 1.228 msm. The volume is lower because of waste along the value chain.

In Europe, import is slightly bigger than export. AWA estimates that ~10% of all adhesive tape production in Europe is exported and that of all the adhesive tape in Europe, ~15% of total consumption is imported primarily from North America and Asia.

About Corey Reardon

Corey Reardon has been President and CEO of AWA Alexander Watson Associates since acquiring the business in 1999. He began his career nearly 30 years ago with Loparex (then HP Smith and Rexam Release, where he held a number of positions in product management, marketing and business development, including roles in Brussels, Hong Kong and the Netherlands). He then joined Avery Dennison as Marketing Director for Europe until he acquired AWA. Corey Reardon has a degree in marketing and strategic planning from the University of Cincinnati and a degree in industrial marketing from the Kellogg School of Management at Northwestern University.

Questions and comments?

Corey Reardon

President and CEO

AWA Alexander Watson Associates

c.reardon@awa-bv.com

www.awa-bv.com

Koningin Wilhelminaplein 13

2.10.03 (Tower 2, Floor 10, Suite 3)

1062 HH Amsterdam

The Netherlands

+31 (0) 20 676 20 69