Exclusive market data: sustainable shipments and manufacturing process streamlining to trigger extensive adoption of flatback tapes

Flatback tapes are gaining steady popularity across various end-use industries on grounds of their undeniable versatility. Few of the key characteristics, hand-tearable being a prominent one, makes them ideal for use across splicing, packaging and masking applications. Manufacturers are vying to scale up the performance and reliability quo of their offerings in a bid to satisfy the most challenging set of applications. In order to serve diverse specifications, such as stronghold and easy handling, key stakeholders in the flatback tapes market are investing in progressive research and development activities to encourage the influx of new user-oriented products in the marketplace.

Although flatback tapes make for an excellent carton sealing application, owing to its superior adhesion, tensile strength and tear strength, its competency in offering superlative tacking and material strength has paved way for more diverse applications in electronic components and equipment manufacturing.

Restoration of consumer confidence in retail is pushing the growth of FMCG, which is further complementing the high-scale adoption of flatback tapes. Asia Pacific except Japan (APEJ) and North America to represent 2 of the highly remunerative regions for the market players to forge ahead with investments. Rapid industrialisation and upswing in global trade activities are critical factors favouring lucrative opportunities for flatback tapes manufacturers in the Asia Pacific.

Multipronged process streamlining pushes adoption of custom-printed and printable flatback tapes in manufacturing and packaging industries

Printable flatback tapes are witnessing escalating adoption across various manufacturing units, as they offer the convenience of accommodating high-definition graphic prints. Printable flatback tapes are also ideal for incorporating barcodes, QR codes, and other labelling formats requiring high fidelity, fostering their popularity in enterprise stock control and inventory ecosystems. The use of colour-coded flatback tapes is picking up pace across the manufacturing industry, in a bid to create an efficient labelling system facilitating seamless control of stock and inventory.

Moreover, printable flatback tapes are also registering high demand from manufacturing companies as they offer high functionality apropos of logos and destination labels. From the implementation of convenient item designation framework to easy processing of shipments by the package handlers, custom-printed flatback types are evolving as an ultimate solution for multiple organisational units. Printable flatback tapes facilitate immediate dispersal, when combined with paper substitutes, and also promote clean removal. This, in turn, makes them highly-preferred in case of automated boxing systems and temporary labels.

Adoption of flatback tapes to gain tailwinds from rising prominence of eco-friendly shipments

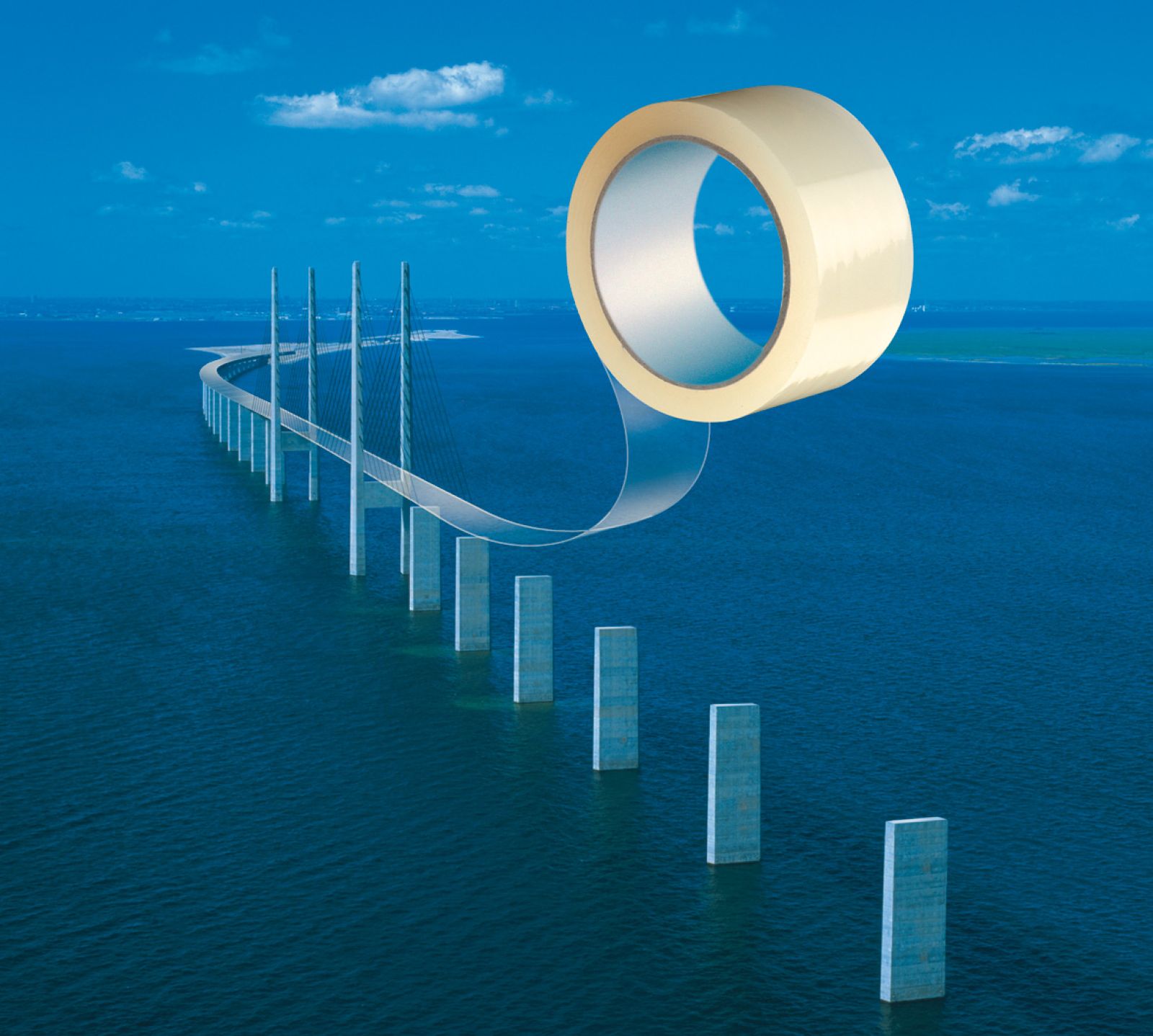

Online shopping has been gaining an overwhelming response in recent years, with rising preference for the convenience of choosing from a wide array of options. And with this elevating popularity of online shopping, the number of parcels being shipped across different locations is also increasing. But, the scenario associated with wastage of cardboards and bubble wraps used for the shipment packaging is getting worse.

As per the Environmental Protection Agency (EPA), containers and shipping packaging make up a maximum portion of municipal solid waste (MSW), amounting to around 77.9 million tons in 2015. Several leading companies are vying to offer sustainable shipping supplies, in order to comply with the eco-friendly formats. This rapid gravitation toward biodegradable formats is likely to spur the demand for flatback tapes, being a prominent and popular paper-based tape. Flatback tape is highly likely to be preferred for low volume shipments, with paper backing and pressure-sensitive adhesive.

Quest for high-performance and economic adhesive solutions to spur adoption of flatback tapes in manufacturing ecosystems

Tapes are of paramount importance for paper, tube, and core manufacturing processes, in order to carry out efficient roll startup, end tabbing, and splicing applications within a shorter time period. Tape failure comes at huge costs, especially when it leads to wastage of materials, production slowdown, missed deadlines, and safety hazards. With the alarming need to facilitate seamless production at reduced cost and time, flatback tapes are witnessing an elevated adoption, by virtue of reliable dimensional stability along with superlative tensile strength.

In case of paper, tube, and core manufacturing, flatback tapes provide excellent assistance in securing paper to the core during roll startup, holding the splice during processing, and anchoring the end of the roll in a secure manner. In addition to that, flatback tapes are also being increasingly embraced by tasks involving aggressive adhesion, including overlapping and shingling applications, complementing the optimistic outlook for flatback tapes market. Furthermore, exceptional adaptability in porous and rough surfaces is a predominant characteristic of flatback tapes that enhances its appeal across paper mill and converting facilities.

Flatback tapes with rubber adhesive to gain end-user confidence, quality retention amid adverse conditions remains the key USP

Adhesives hold a significant spot in the overall manufacturing cost framework of tapes. The appeal of flatback tapes with rubber adhesive is likely to gain prominence in the end-user spectrum when compared to other adhesive types. A multitude of end-user industries, namely food & beverages, automotive, building & construction, and paper and paper-based products manufacturing, are likely to register massive demand for flatback tapes with rubber adhesive. Enhanced competency to withstand extreme weather conditions, such as high temperature or dry wind, is fostering its adoption across several end-use industries and associated applications.

High tacking strength combined with amplified product life are 2 of the key factors fostering end-user confidence in rubber adhesives. Adhesives, such as acrylic, silicone and other types, are less economic when compared to rubber-based variants, which further boosts its overall appeal amid the market space. Rubber adhesives do not entail an additional solvent or heat energy for application on any surface, which remains one of the key advantages associated with its usage. Flatback tapes with rubber adhesive require minimal dwell time to establish a good contact with any surface, wherein other adhesives do not fit the bill in offering the desired efficiency.

High tacking strength combined with amplified product life are 2 of the key factors fostering end-user confidence in rubber adhesives. Adhesives, such as acrylic, silicone and other types, are less economic when compared to rubber-based variants, which further boosts its overall appeal amid the market space. Rubber adhesives do not entail an additional solvent or heat energy for application on any surface, which remains one of the key advantages associated with its usage. Flatback tapes with rubber adhesive require minimal dwell time to establish a good contact with any surface, wherein other adhesives do not fit the bill in offering the desired efficiency.

New products with enhanced properties to strengthen the future of flatback tapes

Manufacturers of flatback tapes are increasingly analysing the end-user propensities to offer a wide range of value-added offerings. Manufacturers are offering abrasion and oil-resistant tapes, upgrading the competency of serving diverse applications. Manufacturers are also offering flatback tapes of high-intensity colors for easy identification, even in case of high-speed orientations.

In line with the rising demand for moisture resistant flatback tapes to cater to applications including silk screening, packaging, picture framing, and beaming/leasing,manufacturers are continually evaluating sealing and adhesion properties. Persistent efforts of the key stakeholders to diversify the product lines, in order to offer efficient and adaptable products, are likely to rev up the growth potential of flatback tapes market.

The above insights have been sourced from an extensive ongoing research study on the flatback tapes market by Future Market Insights.

About Ismail Sutaria

Ismail Sutaria is a seasoned packaging consultant with over 5 years of industry experience comprising the consumer goods and materials landscape. He has helped numerous organisations with in-depth and accurate research reports and market intelligence. Mr. Sutaria is a regular at industry conferences and expos and has been widely covered in both electronic and print media. His key skills include competitive benchmarking, market opportunity assessment, and macroeconomic analysis. A few of the industry verticals in which he has recently demonstrated his skills include industrial packaging, thermoform packaging, plastic bags & sacks, folding cartons, digital printing for packaging, moulded fibre pulp packaging, blow fill seal technology, bag-on-valve, parenteral packaging and liquid packaging cartons.

Questions and comments?

Anu Chitnis

Marketing Communications

Future Market Insights

anu@futuremarketinsights.com

+91 9850845558

www.futuremarketinsights.com