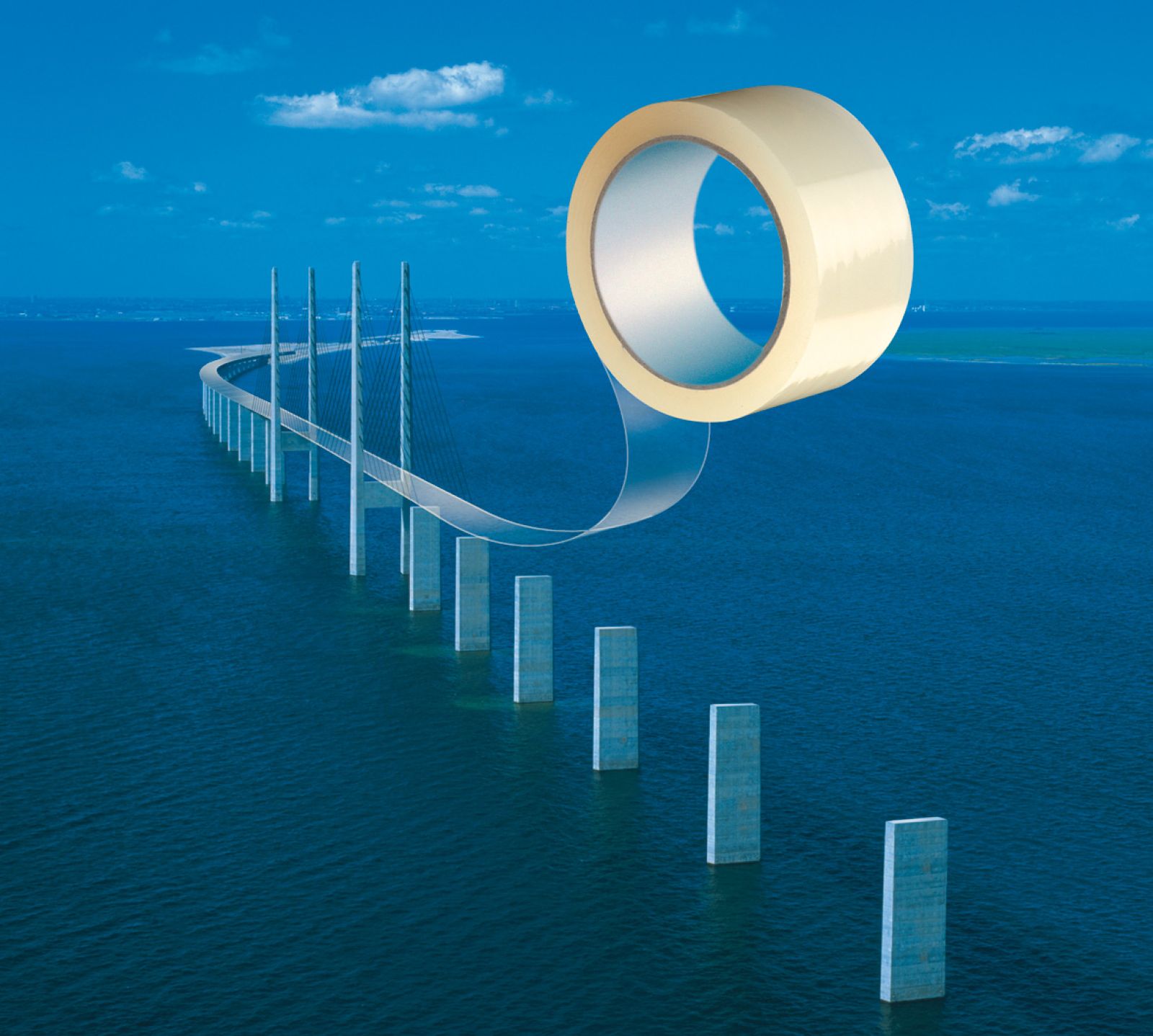

Recognising PSA industry trends worldwide: What will 2021 bring?

Evert Smit, President of Afera and Director Scouting at Lohmann GmbH & Co. KG, recently shared his views on pressure sensitive adhesive (PSA) industry world trends as he sees them developing. “We are watching and reacting to the trends we see driving the Industry at different speeds,” he explained. Firstly, all of the information we currently have about trends is outdated, as this was based on past data till the beginning of 2020, before the advent of the COVID-19 crisis. “So anything that is going to happen in 2021 cannot be deduced from pre-2021 market data and trends.” He does feel, however, that there are some overriding themes that are worth noticing.

Evert Smit, President of Afera and Director Scouting at Lohmann GmbH & Co. KG, recently shared his views on pressure sensitive adhesive (PSA) industry world trends as he sees them developing. “We are watching and reacting to the trends we see driving the Industry at different speeds,” he explained. Firstly, all of the information we currently have about trends is outdated, as this was based on past data till the beginning of 2020, before the advent of the COVID-19 crisis. “So anything that is going to happen in 2021 cannot be deduced from pre-2021 market data and trends.” He does feel, however, that there are some overriding themes that are worth noticing.

The future of the markets we all work in

“Without mentioning specific markets as they range greatly over our Membership’s businesses, I think going forward there will be a permanent shift away from some areas and into other areas,” said Mr. Smit. “Perhaps AWA will confirm this in its upcoming Global PSAs Market Study in 2021? I truly believe that we will not return to the business landscape of 2019 — nor should we try to.”

When asked, AWA Alexander Watson Associates, which monitors the market for its Global Pressure Sensitive Adhesives Market Study, due out next in 2021, responded with some early data to share with Afera Members. Firstly, global growth for PSAs is predicted at a 4.9% CAGR between 2018 and 2021, Asia being the only region outpacing this at a CAGR of 6.9%. The European market will expand by 3.5% over the same period. The tapes and medical adhesives segments will see the most growth, both at a CAGR of 5.2%.

In 2019, water-based adhesives accounted for 819,796 dry tonnes or 37% of global adhesive production, while hot melt adhesives accounted for 772,148 dry tonnes or 33%, and solvent-based 619,329 or 28%. UV-curable hot melts and silicone accounted for just 46,253 or 2% and 16,698 or 1% all adhesives, respectively.

In 2019, water-based adhesives accounted for 819,796 dry tonnes or 37% of global adhesive production, while hot melt adhesives accounted for 772,148 dry tonnes or 33%, and solvent-based 619,329 or 28%. UV-curable hot melts and silicone accounted for just 46,253 or 2% and 16,698 or 1% all adhesives, respectively.

According to AWA, silicone (7.3%), UV-curable hot melt (6.0%) adhesives and water-based adhesives (5.8%) will experience the highest global growth as technologies between 2018 and 2021 in compound annual growth. This can also be accounted for across the regions from 2015 to 2018, with Asia’s use of silicone (9.2%), water-based (7.8%) and UV-curable hot melt technologies outpacing the other regions in CAG.

Going green?

Going green?

We have been seeing a shift towards water-based and hot melt technologies – away from solvent – over the past few years, and this may be more pronounced in 2021, but we will probably see this happen to a higher degree in 2022. From 2015 through 2019, Asian demand for water-based and UV-curable hot melt technologies rose 48% and 45% in real terms, while demand for solvent-based technologies only rose 30% in comparison. The trend was similar in Europe: 16% and 20.0% compared to 4.5%. In North America: 18% and 26% compared to 7%.

Going forward? “The thing is we cannot actually determine how much more green technologies are going to expand – 5, 10 or 15% more? Nobody knows whether the shift will continue at the same pace or speed up,” said Mr. Smit. “That is an insecurity we all have now, because we have realised we cannot foresee where we are going strictly based on past data, and we cannot see how the world is going to respond to the new circumstances.”

Sustainability

At an accelerated pace, issues around sustainability are coming to the fore both in Europe and China and, after a change in the Oval Office, likely in the U.S. too. In its recently set development goals for 2021-2025, the China Adhesives and Tape Industry Association (CATIA), 2 of 6 points revolved around “promoting energy conservation, emission reduction and environmental protection” and “adhering to green and sustainable development”.

In its Facts & figures 2020, FEICA (The European Adhesive and Sealant Association ) states that “issues of sustainability continue to be a major influence on adhesive and sealant demand” due to the upward trends in e-commerce (responsible paper and board use), and although stifled by COVID-19 in 2020, building & construction (energy efficiency, retention and sustainable generation). FEICA believes that the next few years will be characterized by “a greater focus on decreasing dependence on fossil-based raw materials and increased demand for safe, sustainable adhesive and sealant products, where price and quality remain key.”

According to Mr. Smit, the tape market should see an overall trend towards greater sustainability, recycling, renewables, etc., especially for adhesive makers and carrier and liner makers, who are at the forefront of the Industry when it comes to R&D.

Suppliers lead the way in the ‘new normal’

“It’s going to be tough, and companies are going to be forced to adapt whether they like it or not,” warned Mr. Smit. “With environmental regulatory pressure and the shortening and thickening of supply chains, the ‘new normal’ is going to be hard on some companies, especially those who are not convinced that they need to evolve or do not possess the network with which to do this. This is one of the key challenges and opportunities we are currently addressing within Afera.”

Adhesive suppliers, which are often larger than tape manufacturers, are some of the innovators dictating the trends and are setting themselves up well for a greener future, which tape manufacturers can follow. “But whether they make it depends on their individual business strategies….”

All data provided by AWA. Download the presentation here. For more information, visit www.awa-bv.com or email info@awa-bv.com.